1. Red Sea risks rising rapidly

2. Creditor protection

3. Neglecting information transfer

4. Green financing

5. Reefer results

6. UK cadets

7. Claims against hackers

8. Seal failures

9. Ship waste

10. Hydrogen rules

11. Hague Convention

12. IMO Secretary General

13. Cooperation agreement

14. Sail endorsement scheme

Readers’ responses to our articles are very welcome and, where suitable, will be reproduced. Write to: contactus@themaritimeadvocate.com

1. Red Sea risks rising rapidly

By Michael Grey

What do we think of one of the world’s main trade routes suddenly coming under attack from drones, missiles, pirate militia and hijackers? The fact is that nobody other than those whose ships customarily use this vital waterway have even noticed, media attention being focused almost entirely on the landside activities in Israel and Gaza. But this interconnected and peripheral problem is of vital importance, if the Red Sea and Gulf of Aden are not to become maritime war zones, with grim effects upon so many international trades.

The pictures of the gleaming NYK car carrier Galaxy Leader, following her hijacking by Iranian-backed Houthi militia, steaming into Hodeidah roads, escorted by triumphant rebels in speedboats, ought, above all else have shown the world that these people mean business. We were treated to a video, helpfully provided by the apparently well-funded Houthi PR wing, showing the bewildered crew of the ship being lectured by some uniformed official, said to be the naval chief of staff, but might be better described as a local pirate commander.

Since then, there have been attempted seizures of ships said to have a connection, however tenuous this might be, to Israel, missile attacks on both merchant ships and warships. Ships have already been diverted, which is not something done easily, bearing in mind the costs and extent of any diversion. It is a situation with the potential to become far worse, if this is not nipped in the bud. There is just no way the world can tolerate any group of armed and dangerous rebels setting themselves up to decide which ships are to be permitted through an international sea lane, and those chosen to be attacked.

One has to ask where the intelligence is located, which facilitates this apparent discrimination between ships which might conceivably have some connection in their beneficial ownership and others. Are shadowy figures ploughing through the pages of the Lloyd’s Confidential Index or making multiple requests to those keeping public companies’ records? It is a nasty reminder of the bad old days, when there was a general Arab boycott of Israeli shipping and the measures that this required to keep shipping operating, reminiscent of the confidentiality required in wartime.

It is also worth thinking that such a situation as is developing, sends a grim message about the very transparency that we are all encouraged to foster. It might be suggested that the undoubted benefits of AIS are menaced when it enables hostile forces such useful access to potential targets. We already have the tanker fleet carrying sanctioned Russian cargoes cheerfully switching off their identification systems, in contravention of international rules, but with important safety implications. These are all good reasons to sort out this menace afflicting the Red Sea, with what extreme prejudice might be necessary, once and for all. Failing that there is no doubt that seafarers’ lives will be put at risk and we will be on the road to the same sort of measures, requiring armed protection and convoying, that were found necessary in the 1980s Gulf confrontation. But before we get to that extreme situation, the world might have noticed.

Law on your side

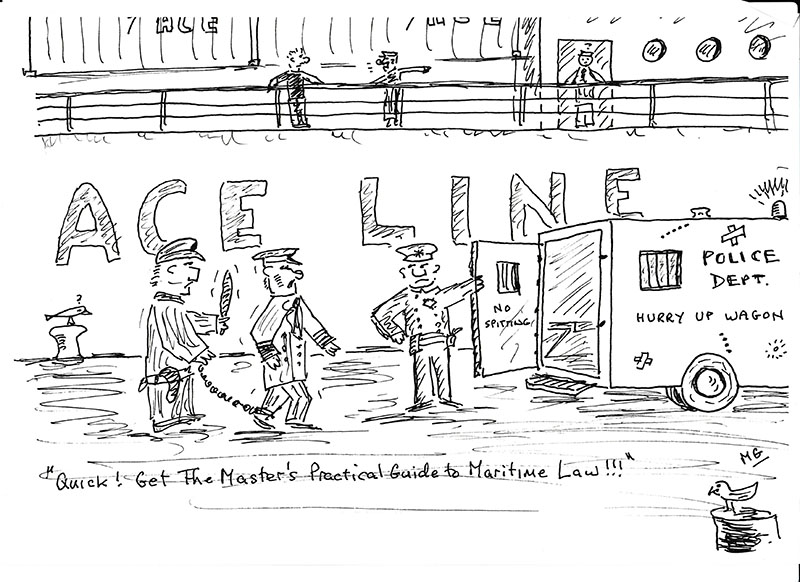

The co-operation between the International Chamber of Shipping and the International Federation of Ship Master’s Associations to produce “The Master’s Practical Guide to Maritime Law” must be surely welcomed. It is designed, not as a text book for people whose eyes are already being ruined by the number of words they must read, but a helpmeet to assist in navigating common legal pitfalls they inevitably meet in their professional lives. It brings real-world and contemporary issues to the fore and benefits from the experience of several serving shipmasters who were involved in its production. It is obviously worth checking out with either of the two organisations.

Michael Grey is former editor of Lloyd’s List

2. Creditor protection

Brian Perrott and Stephanie Morton of HFW have put together some words on the issue of creditor protection in the law firm’s online series of London Calling comments.

Section 423 of the Insolvency Act 1986 aims to provide protection against transactions which defraud creditors. Its interpretation has been clarified by a recent judgment of the English Court of Appeal.

A bank was claiming sums from a debtor who had allegedly taken steps to disguise his beneficial ownership. It was alleged that the debtor had disguised ownership of certain assets by transferring them to family, or causing the company which owned them to transfer them.

Two main issues of law were before the Court:

1) Can a debtor enter a transaction with a third party within the meaning of s.423 if their acts are to be regarded legally as acts of a company?

2) Can a ‘transaction‘ be entered into within the meaning of s.423 if the assets are not beneficially owned by the debtor?

Decision

The Court decided that acts which were factually committed by an individual, but which could be attributed to a company, could fall within s. 423.

The Court also interpreted the term ‘transaction’ broadly – holding that it does not require the transfer of any assets. By extension there was no requirement for assets to be beneficially owned by the debtor.

The purpose of s. 423 is to provide a mechanism to avoid transactions at an undervalue which have been made for the purpose of defrauding creditors. There are strong policy considerations in favour of this.

This case demonstrates that the Court is willing to adopt a broad approach to the interpretation s.423 to further this purpose.

Invest Bank PSC v Ahmad Mohammad El-Husseini [2023] EWCA Civ 555

Back to Earth

Brian Perrott and Colin Chen have also considered the recent judgment below.

The High Court has confirmed its decision to refuse permission for a derivative claim against an oil and gas company’s directors.*

ClientEarth (CE) is an environmental NGO that held 27 shares in Shell Plc. CE sought to continue a claim brought on Shell’s behalf against Shell’s directors for breaches of duties under the Companies Act 2006.

Such duties included: (i) promoting the success of the company for the benefit of its shareholders (s. 172); and (ii) exercising reasonable care and diligence (s. 174).

Broadly speaking, CE alleged that the directors were in breach by failing to: (i) set an appropriate emissions target; (ii) implement an adequate climate risk strategy; and (iii) comply with a Dutch court order imposing an emissions reduction obligation of 45% by 2030.

The Court held that CE failed to establish a prima facie case and permission to continue was refused. Amongst other things, the Court decided that a person acting in accordance with s. 172 would not seek to continue the claim. The test for breach of s. 172 is subjective and requires proof of conduct that was not in good faith. CE could not provide such proof.

An allegation of breach of an incidental duty to allocate appropriate weight to climate risks was unsuccessful on the basis that this could not override all other considerations as to how to promote the success of Shell for its shareholders. Further, the directors had discretion as to how to comply with the Dutch court order, and had not acted unlawfully.

CE’s modest shareholding also suggested an ulterior motive of advancing its own policy agenda, rather than supporting the interests of Shell’s other shareholders.

This judgment demonstrates that a relatively high threshold needs to be met to progress a derivative claim. It appears that directors have broad discretion in relation to company management and decisions, including as to climate risks. However, directors should nevertheless consider climate risks as appropriate.

*ClientEarth v Shell Plc and others [2023] EWHC 1897 (Ch)

3. Neglecting information transfer

In its latest Claims Review, International Transport Intermediaries Club (ITIC) shed light on a case where a failure in information transfer sparked a dispute over the payment of an Additional War Risk Premium (AWRP).

The situation unfolded as a tanker was contracted for a voyage featuring an option to call at an AWRP area. Per the terms of the charterparty (CP), the charterer was liable to pay the AWRP if the vessel ventured into the specified area.

Crucially, the shipowner was obligated to obtain an AWRP quotation and transmit it to the charterer for approval “as soon as possible” and “before the owner pays the AWRP”. The shipowner fulfilled this obligation by passing on the necessary information to the ship broker.

However, when the owner notified the charterer of their AWRP claim, it became apparent that the ship brokers had failed to convey the initial quotation. Consequently, the charterers refused to pay the AWRP.

ITIC argued that the decision to enter the AWRP area was a conscious one, and the delayed notification did not cause any losses as the quotation aligned with market standards. Therefore, the delayed notification was not causative of any loss to the charterers. Despite these efforts, the charterers maintained their stance, citing a breach of the CP terms by the owners – which was technically correct.

The breach rendered the shipowner eligible for a valid claim against the ship broker. Ultimately, the broker had to reimburse the US$ 60,000 AWRP to the owners, which was covered by ITIC.

Mark Brattman, Claims Director at ITIC, emphasised the significance of attention to detail in such a transaction, stating: “This case really highlights the importance of attention to detail, especially when it comes to passing on crucial information. Unfortunately, such oversight can lead to financial losses and even disputes between the parties involved. Having Professional Indemnity insurance can offer a safety net in such situations. Therefore, prevention is key, but having expert support is just as crucial.”

The full Claims Report can be found at: https://www.itic-insure.com/fileadmin/uploads/itic/Documents/Claims_reviews/Claims_Review_49.pdf

4. Green financing

Hamburg-based ship finance platform oceanis has been looking at the Green Financing landscape in its Q4 State of Ship Finance Report

According to the Executive summary:

- Green financings apply mainly to newbuild and very modern vessels, excluding smaller shipowners with older vessels

- Financiers disagree on the meaning of ‘greenness’, making shipowners’ options less clear

- Higher base rates and margin compression have made Commercial Bank interest costs much closer to those of Poseidon Principles Banks

- Consequently, the green discount on financing costs is lower than in previous years

To state the obvious: Ships, being large and slow, are extremely energy efficient at carrying cargo when compared to trucks, trains and aircrafts. Therefore, comparing different modes of transportation, shipping is the most environmentally friendly. Still, progress made in the shipping industry, as one of the biggest emitting industries of greenhouse gases, can have a major impact on global emission levels.

Over the past decade oceanis says it has seen large changes to the ship financing landscape towards greener projects. The most obvious green financiers are the Poseidon Principles banks, the initiative launched in 2019 whose signatories manage 70% of the world’s shipping loans.

At the same time, many other banks and funds are moving away from financing ‘brown’ assets and trades. With the strictest lenders not financing vessels carrying any fossil fuels, even coal-carrying Kamsarmaxes and larger Bulk Carriers. This list of banks and funds will continue to grow. Rumours suggest that another $20bn of loans will be managed by financiers with this policy by 2024.

So, what makes a ship ‘green’ or not? There are two schools of thought amongst lenders. Most lenders focus on the vessel’s own emissions via metrics such as AER and CII ratings. On the other hand, some see the vessel’s cargo or industry as more relevant. For example, is a Newcastlemax or VLCC really ‘green’ even if it is ammonia-powered? Are Wood Pellet Carriers the greenest vessels afloat? Taking it to the absurd, could a Wind Turbine Installation Vessel burn coal and still be seen as ESG-friendly?

This last point is a real paradox in ‘green shipping thought’. Is the vessel carrying oil or oil products responsible for those cargoes being burned? And are there other effects at play?

With new reporting rules coming from the EU, the vast majority of shipping banks, not only the Poseidon Principles banks, will be forced to calculate and share their loan portfolios’ emissions. It is likely that future regulations will force a slow reduction in total emissions for each bank. Their calculated emissions are based on economic exposure – a loan of 50% of the vessel’s value means that the bank is responsible for 50% of the emissions. According to the existing regulatory structure, the ship is only responsible for the oil it burns and not for its cargo. For this reason, oil-carrying ships will remain well financed for the time being.

Erlend Sommerfelt Hauge, Managing Partner at oceanis, says: “On pricing, commercial banks are a refuge for shipowners who have less of a green agenda. Smaller commercial banks are getting very close to Poseidon Principles banks.”

He adds: “For many shipowners, perhaps the restrictions on vessels and trades make Poseidon Principles margins a less attractive partner than the alternatives. Due to today’s high base rates, a 50 basis point difference in margin from 2.00% to 2.50% represents only 7% of total interest costs. Will the reduced interest costs outweigh the earnings that could have been made?”

For a full copy of the report, go to: https://api-prod.oceanis.io/reports/pdf/Oceanis-Q4-Market-Report.pdf

5. Reefer results

In the final quarter of the year, the outlook for seaborne reefer trade has weakened with cargo demand now expected to post a second consecutive year of decline. Meanwhile, transit restrictions on the drought-stricken Panama Canal are starting to impact vessel capacity serving exports of perishables out of the West Coast of South America according to Drewry.

A convergence of factors, ranging from climate impacts on key fruit crops, to weak Chinese demand and geopolitical tensions, have dampened the short-term outlook, with total seaborne reefer cargoes for 2023 forecast to decline -0.5% YoY, according to Drewry’s Reefer Shipping Forecaster report published recently. This will follow last year’s contraction of 0.8% and will represent two consecutive years of declining trade.

Meat remained the largest commodity by volume in 3Q23. Despite strong pork exports from the US and Brazil so far this year, this segment has been slowed by declines in beef exports and continued weak demand from China. In the fish and seafood sector, demand has also waned, as marine heat waves in the Atlantic have added risks for piscine ecosystems and catches have been consistently low in the year to date.

Across the fruit sector, there has been a noticeable trend of reduced exports from almost all major producing regions, as El Niño effects have amplified weather events. Scarcity of quality produce has driven declines in deciduous, exotics, and melons and berries exports. The banana trade has also faced difficult operating conditions, with increasing cost pressures and weak demand resulting in flatlining seaborne exports this year.

See https://www.drewry.co.uk/ for the full story

6. UK cadets

The first conference for UK cadets has revealed some stark contrasts with their fellow Gen Z seafarers across the globe.

International maritime charity Sailors’ Society held the ground-breaking virtual event as part of their global 2023 Wellness at Sea Maritime Schools’ Conferences, which also saw events for cadets in North and South East Asia and Africa.

More than 4,000 cadets attended these events and polls taken during the conferences, on everything from the cadets’ motivation for a career at sea to their views on diversity, revealed that cadets from UK schools had very different views to those training elsewhere in the world.

Unlike cadets from Indian and African continents and the Pacific, UK cadets were not concerned about securing a job post-graduation. Despite 86% of North Asian cadets revealing they had yet to have their first experience of seafaring, it was the UK cadets that were unique in saying their biggest concern was not being able to cope with life at sea.

The conferences, now in their third year, also revealed that a greater percentage of UK cadets saw their time at sea lasting just five years compared to cadets elsewhere who overwhelmingly saw this as a long-term career.

Sailors’ Society CEO, Sara Baade, said: “We have designed these events to offer a unique opportunity to equip cadets for their future careers.

“We’ve brought together top industry experts to give a real insight into the realities of life at sea and we’ve given participants the tools they need to look after their own mental and physical health.

‘But these events also give a voice to these young people, allowing them to speak to the industry they are about to join.

“Sailors’ Society’s approach to hosting conferences across diverse regions not only allows for a deep dive into local trends but also contributes to a holistic view of wellbeing, mental health and maritime education and training for our new generation of seafarers.”

The full data from the four conferences along with analysis from industry experts will be published in the Society’s 2023-4 cadet report due out in the Spring of 2024.

7. Claims against hackers

In a recent viewpoint piece Hill Dickinson takes a look at claims against hackers in its latest piece on cyber issues.

Ransomware cyberattacks (typically involving use of malicious software designed to block access to electronic information pending payment of a sum of money) have surged over recent years, with some very high-profile victims. In Armstrong Watson LLP v Persons Unknown [2023] EWHC 1761, the victim of a ransomware attack took swift legal action against the unidentified threat actors leading to a judgment and final injunctions in their favour.

The Claim

The claimant, Armstrong Watson LLP, provides professional accounting, tax, financial and related services in the UK. In February and March 2023, hackers were able to obtain a quantity of the claimant’s confidential electronic documents as a result of a ransomware cyber-attack. The threat: pay a ransom or the information would be disclosed or sold, including on the dark web.

The claimant issued a claim for breach of confidence and applied for an urgent interim injunction against ‘persons unknown’. The injunction application sought an order requiring the hackers to identify themselves and to deliver up and/or delete the information (amongst other things).

A claim for breach of confidence will arise where a) information has the necessary quality of confidence, b) the information has been obtained by the defendant where there exists a duty of confidence, and c) the defendant breaches that duty of confidence by accessing, obtaining, retaining, using, publishing, communicating and/or disclosing the information (and/or intending and/or threatening to do so). Other common causes of action against threat actors include proprietary or tracing claims and claims in restitution and fraud.

The court granted the injunction on the terms sought with provision for a ‘return date’ hearing. The claimant was able to serve the papers via the website used by the unidentified defendants to communicate.

Perhaps unsurprisingly, the defendants did not respond to the injunction order and did not turn up to the return date hearing. In doing so, they were in breach of the injunction. In their absence, the court continued the injunctive relief and issued directions for the claim, including for the service of a defence by a certain date. When the defendants failed to file a defence, the claimant applied for default judgment, final injunctive relief and derogations from open justice to protect the confidentiality of the case papers consistent with the substantive relief it sought.

The Outcome

The court granted default judgment and made the interim injunction final. The defendants were restrained from using and disclosing the information, required to delete or deliver up the information, and to provide a signed witness statement confirming compliance.

Are the hackers likely to comply with the terms of the order? It seems unlikely; first and foremost, the hackers will not want to identify themselves. Further, if the hackers are based abroad, they may be beyond the reach of the civil courts of England and Wales. However, the claim and final order i) send a clear message that the claimant would not be entering into negotiations in respect the ransom, ii) may deter the hackers from releasing the information (and any further potential hackers from targeting the claimant in the future), and iii) shows the claimant taking proactive steps to protect its confidential information (and that of its customers). Further, it is possible that the identity of the hackers may become known in the future following criminal investigations.

Learning Points

The appropriateness of legal claims against hackers, including applications for urgent injunctive relief as in the Armstrong Watson LLP claim, should always be considered on a case-by-case basis. Targets will want to weigh up a number of relevant factors, including the impact of the attack (specifically whether it is ongoing), the likely outcome of litigation and associated costs and deterrence.

See insights@communication.hilldickinson.com

8. Seal failures

Seawater-lubricated bearings pioneer Thordon Bearings has welcomed the publication of Gard’s latest research into the potential hidden costs of synthetic Environmentally Acceptable Lubricants (EALs).

Far-reaching financial and environmental consequences can result when a propeller shaft seal failure occurs, with the Norway-headquartered marine insurance firm pointing to a “significant increase” in propeller shaft aft seal damage following the 2013 introduction by the US EPA of new Vessel General Permit (VGP) rules.

According to Gard, the increase in the number of seal failures directly correlates with the increase in the use of approved synthetic lubricants – these lubricants are among those in compliance with US EPA regulations.

Gard’s research, published in October 2023, has taken a deep dive into the data around the shaftline damage claims it has processed over the last 10 years. Its research shows that as many as 80% of the incidents Gard investigated involved stern tube seal failures where an EAL was in use.

Thordon Bearings’ VP of Business Development, Craig Carter, said: “It appears that the introduction of a synthetic EAL as a means of mitigating the risk of mineral oil pollution has had unforeseen consequences. Seawater alone is the only 100% pollution-free means of lubricating a ship’s propeller shaft bearing.”

Gard’s research has suggested that one reason for the seal failure hike (and consequent increase in insurance claims) is based on the chemical composition of synthetic EALs, which, while being environmentally preferable to the mineral oils that are being phased out, are typically inferior in performance.

Gard cites a 2019 study by DNV which discovered that two key features of EALs set them apart from the traditional mineral oils widely used before 2013: viscosity and pressure coefficient.

Under high load operations, such as hard turns at high speeds, EALs can operate with a lower safety margin of the minimum oil film between the propeller shaft and the bearings. Secondly, EALs typically operate with lower viscosity under lower temperatures, in situations like mooring trials and cold start-up.

Touched on by Gard, there have also been countless reports in the international trade press suggesting that the increased incidences of discarded fishing nets or rope are adding to the aft seal damage of oil-lubricated shaftlines.

“This research from Gard underscores our own findings that the most environmentally acceptable lubricant is seawater as was recommended by the US EPA in the Vessel General Permit (VGP)” said Carter.

“Thordon’s COMPAC bearings are at the heart of our award-winning open seawater-lubricated propeller shaft bearing system, which means zero oil pollution into the marine environment. And let’s not forget any oil leak, big or small, can be catastrophic to the marine environment and marine life, with some EALs found to be only slightly less damaging than the phased-out traditional oils.”

The Thordon COMPAC system eliminates the need for the aft seal, as well as offering reduced friction, hence diminishing fuel burn and main engine emissions. This proven shaftline design also provides improved bearing wear life, predictability and reliability while offering lower maintenance costs, easier installation, and future-proof compliance.

To read the Gard report in full, please visit: https://www.gard.no/web/articles?documentId=36102314

9. Ship waste

A new EU agreement on waste shipments is set to remove a legal roadblock to make it possible for a raft of non-OECD ship recycling yards to be included on an EU-approved list, which would unleash much-needed shipbreaking capacity for a massive wave of tonnage due to be scrapped over the coming years, according to green recycling consultancy Sea Sentinels.

The European Parliament and Council have agreed to allow exports of hazardous waste, including that contained in EU-flagged ships, to non-OECD countries provided receiving facilities can document sustainable management and disposal of this waste in line with EU regulations under a proposed amendment to the EU Waste Shipment Regulation (WSR) expected to be ratified by year-end. This would be subject to the receiving facility being included on an EU-approved list.

Ships that are sold for recycling at the end of their lifetime contain hazardous materials such as asbestos, ODS, mercury and many others, as well as operational substances and waste including oil, fuel, ballast water and sludge, which constitute a risk both to human health and the environment if they are not managed and disposed of properly.

Exports of such waste in EU-flagged ships are currently banned by the EU under the Basel Convention on transboundary movements of hazardous waste, or Basel Ban, that is transposed into the WSR. In addition, the EU Ship Recycling Regulation (EUSRR) sets stringent standards for ship recycling and requires all EU-flagged vessels to be recycled at a facility on a list of approved yards.

“The latest EU agreement would represent a significant legal shift as it would open the way for many yards in non-OECD countries, which have applied for inclusion on the EU list and have been banging on the door for a very long time, to finally gain compliance with the EUSRR,” explains Rakesh Bhargava, Chief Executive of Singapore-based Sea Sentinels.

“At the same time, this would greatly expand the shipbreaking opportunities for many shipowners with EU-flagged vessels who have been constrained by legal and reputational reasons to recycle their vessels at mainly European yards on the approved list with limited capacity for larger ships.”

Bhargava says there are as many as 32 recycling yards in non-OECD countries – including 27 in India and one in Bahrain – that have applied for EU approval, of which some have been subjected to preliminary audits for compliance with the EUSRR, along with eight yards in Turkey and one in the US.

While these non-OECD yards have upgraded their facilities to meet EU standards, their applications have been stymied by the Basel Ban that has effectively barred the way for their inclusion on the EU list, which currently comprises 48 approved yards.

Bhargava believes the pending Brussels directive, which apparently would only apply to EU-flagged ships trading in non-EU waters when the decision to recycle is made, would be a “game-changer” for the shipbreaking industry. He explains it would level the competitive playing field as EUSRR-compliant yards in both OECD and non-OECD countries would all be subject to the same regulations interpreted, applied and enforced uniformly by one common entity.

Danish Shipping’s Executive Director for Climate, Environment & Security, Nina Porst, says the proposed WSR amendment would give non-OECD yards a renewed incentive to raise their standards and pursue EUSRR compliance as it makes inclusion on the EU list a realistic possibility, rather than a theoretical one hitherto precluded by the Basel Ban.

“Provided a yard can meet the standards of the EUSRR for safe, responsible and environmentally sustainable recycling, there is no reason why it should not be approved for the list, regardless of its location,” she says.

“If the WSR amendment is ratified, we would expect to see renewed auditing activity at these yards to expedite the application process for EU approval – and hopefully that will lead to ripple effects with other yards seeking to raise their standards to make the EU list.”

It is important to raise the level of sustainable shipbreaking capacity to cope with an expected flood of older tonnage due for recycling over the next decade as green newbuilds enter the global fleet, which could otherwise lead to a situation of market oversupply, Porst explains.

Industry body Bimco has estimated more than 15,000 ships could be recycled over the next decade, though Porst believes the figure could be even higher with some estimates indicating three times as many vessels could be recycled over the next 10-year period. For comparison, an average of around 700 ocean-going commercial ships have been scrapped annually over the past 10 years, according to statistics from NGO Shipbreaking Platform.

“As well as a high volume of tonnage coming up for recycling, many of these will be larger vessels that many non-OECD yards with EU-compliant facilities would have the capacity to handle,” Porst says.

In its latest Report on the European List of Ship Recycling Facilities, Bimco stated more non-EU yards need to be included on the list to meet the requirement for large-scale recycling of large ocean-going ships as the existing approved yards do not have sufficient capacity, given many are focused on niche recycling or offshore decommissioning.

It stated this leaves Turkey – which has nine yards on the list – as “the only major ship recycling nation contributing significant capacity to the EU list”.

There are presently no facilities from the main recycling states such as India, Bangladesh or Pakistan included on the EU list to meet the demand for recycling of larger ships, even though many yards in these countries have made significant efforts to upgrade their facilities, according to Bimco Secretary General and CEO David Loosley.

Bhargava says non-OECD yards pursuing responsible shipbreaking practices have been given a lift after the IMO’s Hong Kong Convention for the Safe and Environmentally Sound Recycling of Ships was ratified by Bangladesh and Liberia earlier this year, allowing it to finally enter into force in 2025 – 16 years after it was adopted.

“This will finally give us a universally applicable regulatory framework for the global shipbreaking industry that will lift recycling standards across the board and make it more difficult for sub-standard yards to survive,” he says.

But he adds: “Simply selecting a compliant yard will not be sufficient and independent expert supervision throughout the recycling process is necessary to ensure documented compliance with regulations for ESG accountability and reporting purposes.”

Sea Sentinels has been enlisted to supervise and monitor a number of recycling projects at EU-listed yards in Turkey to ensure on-site regulatory compliance to EUSRR standards, according to Bhargava.

“The EUSRR provides the most comprehensive standards currently available in the industry but the non-availability of these standards outside the OECD has a deterrent effect for EU-flagged vessels. These vessels currently have to sail to EU-listed facilities only in the OECD areas, incurring added costs and emissions. A globalisation of these standards would provide options and largely incentivise all shipowners who would want to meet these standards voluntarily,” Bhargava says.

“With the prospect of non-OECD yards now being able to gain inclusion on the EU list, this will give them the required stamp of approval and regulatory legitimacy to allow more shipowners to securely recycle their ships at these locations,” he concludes.

10. Hydrogen rules

Bureau Veritas has launched its first classification Rules for hydrogen-fuelled ships (NR678) to support the safe development of hydrogen propulsion in the maritime sector.

The rules outline technical requirements for the safe bunkering, storage, preparation, distribution, and use of hydrogen as fuel for power generation on board. Monitoring and control systems are also covered, addressing specific safety challenges relating to the transport and use of hydrogen on ships, such as high flammability, as well as the need to store the fuel in very high pressure or low temperature conditions.

BV’s Rules for hydrogen-fuelled ships aim to mitigate the risk of hydrogen leakage, fire or explosion, with detailed requirements for machinery and engine design, as well as the vessel’s configuration and the arrangement of fuel tanks and other systems on board. They also include prescriptions for the ventilation of hazardous areas, venting and pressure relief systems, and monitoring and safety systems including vapour and gas detection.

NR678 also covers “hydrogen-prepared” vessels, which are designed to be ready for the installation of a hydrogen fuel system at a later stage.

These classification Rules complement BV’s existing rule note (NR 547) on fuel cell power systems on board ships that was launched in 2022 in response to growing interest in the maritime industry for fuel cells, and cover all types of fuels including hydrogen. BV is currently working on around 10 projects involving hydrogen as a fuel, either as main propulsion source for smaller ships or as an auxiliary power for larger vessels.

These new rules have been informed by industry feedback and input from a wide range of stakeholders, combined with the land-based hydrogen experience of other divisions within the Bureau Veritas Group. NR678 reflects the latest state of industry knowledge on the use of hydrogen as ship’s fuel and will be periodically updated, in line with the evolution of the technology, as well as regulatory decisions from Flag States and at the International Maritime Organization (IMO).

Laurent Leblanc, Senior Vice President, Technical & Operations at Bureau Veritas Marine & Offshore, said: “The objective of these new Rules is to bring the clarity needed to support industry pioneers as they harness the potential of hydrogen to deliver more sustainable shipping. We are at the start of an important technology turning point, with the introduction of hydrogen as a potential zero-carbon fuel on the road to decarbonisation. We are proud to be writing this new chapter in history together with our partnering shipowners, shipyards, and technology developers, and our colleagues across the BV Group, all of whom have contributed their expertise to help shape these rules, NR678.

“Hydrogen has great potential but its use as fuel by ships is still not common, so it is essential that all guidance is tailored to hydrogen’s specific properties, and this is reflected in these new Rules. At a time when IMO regulation on hydrogen is still being developed, BV is playing a key role in guiding the industry on the technical criteria and risk assessment processes that must be followed to enable innovation, while ensuring that the highest safety standards are met.”

Putting collaboration at the heart of this process, BV is also keen to encourage feedback from stakeholders on these Rules, in order to ensure they reflect the latest experiences and requirements of users.

To download the Rules for hydrogen-fuelled ships (NR678), please click here.

11. Hague Convention

The UK Government has confirmed that it will join the Hague Convention of 2 July 2019 on the Recognition and Enforcement of Foreign Judgments in Civil or Commercial Matters (Hague 2019) ‘as soon as practicable’. Brian Perrott and Jordan O’Brien take a look.

Hague 2019 is an international convention that promotes the cross-border recognition and enforcement of judgments in civil or commercial matters.It will apply in the UK 12 months after the relevant formalities are completed. Therefore, it is likely to apply from 2025 at the earliest.

Hague 2019 applies to judgments which reflect a court’s decision on the merits of a case, including a determination of costs of the proceedings. It explicitly excludes interim measures of protection.

Hague 2019 currently applies in EU states (excluding Denmark) and Ukraine. It will apply in Uruguay in 2024.

Other states have signed Hague 2019 suggesting it may apply in more jurisdictions in the future.

The Convention creates a uniform set of rules for the enforcement of judgments. Therefore, cross-border enforcement should be easier and more predictable for parties, compared with navigating an entirely foreign enforcement system.

Whether individual jurisdictions will respect the rules under Hague 2019 is unknown. Similar agreements, like the New York Arbitration Convention, suffer from variable levels of adherence across the globe.

Hague 2019 only applies to judgments regarding civil or commercial matters. Additionally, it includes a significant list of excluded matters, like judgments regarding the carriage of passengers and goods.Outside the EU, Hague 2019 applies in one state, Ukraine.

Conclusion

The UK joining Hague 2019 will improve the cross-border enforceability of UK judgments. Hopefully, more states join Hague 2019, enabling UK judgments to be enforced far and wide with less friction.

12. IMO Secretary-General

Arsenio Antonio Dominguez Velasco has been confirmed as the next Secretary-General of the International Maritime Organization. The IMO Assembly unanimously approved (30 November) the decision of the Council at its 129th session (C129) to appoint him to the role.

Dominguez Velasco will take up the office of Secretary-General on 1 January 2024 for an initial term of four years, ending on 31 December 2027. He becomes the Organization’s 10th elected Secretary-General.

The outgoing Secretary-General, Kitack Lim, congratulated his successor on his appointment. Lim said:

“I am confident that the Membership as a whole has made a wise decision, and that Dominguez Velasco will ably lead the Secretariat in promoting the mandate of the Organization and in the delivery of its objectives.”

Lim pledged to work with Dominguez Velasco to ensure an orderly and successful hand-over and, in what he called a “symbolic act of transition and succession”, he handed a comprehensive briefing paper to Dominguez to assist him in his preparation for the role of Secretary-General.

Addressing the Assembly, Dominguez Velasco said: “You have my full commitment to build on the great work that has been done by my predecessors, taking what is already a significant and influential organization, to be an institution that will thrive in delivering its full agenda, from safety to decarbonisation, from digitalization to the human element; an International Maritime Organization that not only looks towards the future, but does more in embracing change, diversity, inclusion and transparency; one that is dedicated to its people, from all the very professional staff that form the IMO Secretariat, to our seafarers worldwide and perhaps most importantly, a dedication to the younger generations, the ones we are obliged to hand over to, to hand over a planet that is a better place to live in.”

He concluded,”I want to reiterate how much I’m looking forward to leading IMO, to continue working with all of you, an extraordinary group of people who have demonstrated time and time again that we can deliver, by listening and understanding each other, sharing our aims and concerns. I’m very lucky to start with an already great team of professionals in the Secretariat who also want what is best for the Member States and all our stakeholders.”

13. Cooperation agreement

The Maritime and Port Authority of Singapore (MPA) and the International Association of Classification Societies (IACS) have signed a Letter of Intent (LOI) to collaborate on various maritime digitalisation and decarbonisation initiatives.

The LOI was signed by Teo Eng Dih, Chief Executive of MPA and Nick Brown, Council Chairman of IACS, during the 33rd session of the IMO Assembly (A33) in London.

Under the LOI, both parties will consider the development of technical standards and unified requirements[1] to ensure that new maritime solutions are safely implemented. The LOI will focus on key areas such as smart and autonomous ships, digitalisation and cybersecurity, marine electrification, and the use of zero- and low-carbon fuels onboard vessels.

As part of the collaboration, both parties will have regular information and knowledge exchanges, including discussions on industry challenges and opportunities, standards, best practices, and emerging technologies.

Teo Eng Dih said, “As we advance and accelerate the development of new technologies and solutions which benefit the global maritime community, it is important for harmonised standards to be adopted to ensure that these solutions can be implemented safely. We look forward to contributing and working closely with IACS to shape and develop standards that can help to ensure the safety of seafarers and protection of the marine environment”.

Nick Brown stated “This novel arrangement with the Singapore MPA will assist IACS’ efforts to keep safety at the forefront of the decarbonisation agenda by facilitating access to the data and expertise of one of shipping’s key bunkering and global hub ports. By looking at the entire future fuel supply chain, IACS will be better able to address all the risk and mitigation measures that will need to be implemented onboard vessels and so ensure that safety considerations are front and centre when evaluating the prioritisation and deployment of the new fuels and technologies necessary to support the industry’s transition to a decarbonised future.”

[1] Unified requirements are adopted resolutions by IACS on matters directly connected to or covered by specific rule requirements and practices of classification societies and the general philosophy on which the rules and practices of classification societies are established.

14. Sail endorsement scheme

The Nautical Institute (NI) is updating its International Sail Endorsement Scheme (ISES). The announcement was made at the annual International Sail Training and Tall Ships Conference which took place in Dunkirk, France on the 17 and 18 November. Organised by Sail Training International – a registered charity established to develop and educate young people, regardless of nationality, culture, religion, gender or social background – the International Sail Training and Tall Ships Conference welcomes delegates from around the world who are involved in sail training, including sail training providers, Tall Ship owners,host port organisers of The Tall Ships Races and Regattas, as well as representatives from different sailing and nautical organisations.

The Nautical Institute has long recognised that tall ship sailors require specialist skills and knowledge to operate their vessels safely and efficiently and consequently, in 2014, it developed the comprehensive ‘International Sail Endorsement Scheme’ (ISES) in collaboration with ‘Sail Training International’. Now, almost 10 years later, the ISES scheme has been reviewed and updated, ensuring that it not only remains relevant but also still enables both square rig and fore-and-aft sailors to complete practical tasks and acquire new knowledge before being assessed and endorsed.

Steve Window, Head of The Nautical Institute Academy, said,: ”The NI understands the importance to seafarer career development of having professionally endorsed standards. ISES ensures that all tall ship sailors have access to a standard of proficiency and it has been designed to be a self-driven professional development programme which can be used in conjunction with an appropriate and valid deck certificate of competency (COC).”

No matter what capacity of deck work they are engaged in, candidates complete both practical tasks in addition to acquiring the necessary theory and knowledge that underpin their work. There is also a fast-track route to certification for more experienced sailors.

Notices & Miscellany

Comments on Michael Grey’s piece in MA 843

1. I thoroughly enjoy your regular contributions to the Maritime Advocate says John Schofield.

Not being, like me, a demurrage nurd, you may not have paid too much attention to the Eternal Bliss, as it ping ponged its way through the English courts. In fact its progress therein bears a resemblance to another case making a similar progression over a generation earlier. Both cases started as references to Arbitration. The earlier case was The Laura Prima, a case about the meaning of “reachable on arrival”. In that case, the arbitral process ended with an award. In The Eternal Bliss, the parties referred a point of law to the High Court for a preliminary ruling, which the parties could then use in the arbitral process. The point of law was that demurrage being liquidated damages, just what damages were liquidated. The Owners argued it was just loss of eanings by the ship due to the delay, whereas the Charterers said payment or claiming demurrage precluded all claims, including the one raised in that case which was Owners’ ability to claim reimbursement for cargo damage claims settled with cargo interests.

This is a point of law which goes back over a hundred years to a Court of Appeal decision in a case called Reidar v Arcos. In that case, one judge said it was necessary to establish a different claim other than just loss of earning and/or breach of a separate provision to the laytime provision, a second judge said it was not necessary to establish either and the third judge managed to agree with both!

Going back to the two cases. The Laura Prima was decided by Alan Mocatta in his last Commercial Court decision. Alan Mocatta was a very well respected Commercial Court judge and he reversed the arbitral decision, finding in favour of Owners. In The Eternal Bliss, Mr Justice Andrew Baker also found in favour of Owners. The Court of Appeal reversed both decisions, finding in favour of the Charterers. The Laura Prima then went on to the House of Lords, who restored the judgement of Alan Mocatta in favour of Owners. In The Eternal Bliss leave to appeal was given by the Supreme Court, but just 18 days before the hearing, the parties settled leaving the Reidar v Arcos dilemma unresolved so the law as it now stands is that determined by the Court of Appeal, namely that demurrage blocks all other claims of whatsoever nature.

Rather than wait another 100 years, I have proposed my own clause to resolve the dilemma. I call this my Ravenscroft Eternal Bliss clause. I propose to include in the next edition of my book, Laytime and Demurrage.

“Irrespective of whether demurrage has been claimed and/or paid and whether any other breach of charter has been alleged, other than delay leading to the claiming and/or payment of such demurrage, Owners shall be entitled to claim from Charterers and Charterers shall reimburse Owners in full in respect of any cargo or similar claims paid by Owners, plus interest and costs relating thereto, where delay during the course of the charter has led to such claims being presented”

One academic has suggested it would be easier to get Charterers to accept such a clause if Owners were to only ask for 50%. No doubt it would, but would it be right. My answer is definitely No! The Inter-Club Agreement dealing with apportionment of cargo damage provides that cargo damage arising from stowage should be 100% for Charterers’ account and to my mind storage is an aspect of stowage.

Going back to my Ravenscroft Shipping days, where I was a Director and principal on the Baltic, Ravenscroft were a firm of Baltic Shipbrokers, I would have been urging all our brokers to include this in all time and voyage charters. Although the clause only applies to voyage charters, if it is also included in the head time charter, it is more likely to be included in any sub charter on a voyage basis.

Feel free for you or the Maritime Advocate to use any of the above, any way you wish but I hope I can count on you for support in finding a practical way out of the dilemma caused by the Eternal Bliss settlement.

2. From David Asprey

Michael Grey may well have some good points about so-called “ethical investment”. However, his observations on historic slavery conflate too much the voices of those who, perhaps opportunistically, may see an opportunity to demand recompense, with those who recognise that the 200-year-old slave trade is something repugnant, not only now but also by many at the time, and that it continues to have consequences. This history can be seen in continuing discrimination against slave descendents here, and in the long shadow of the exploitative colonial plantation economies abroad. There are many today who have come to recognise that their present wealth or position, whether as individuals or businesses, is in part built on the financial gains made by their forebears’ participation in slavery. Those who choose, from their own resources, to take practical actions to address this legacy should be lauded, not pilloried. Singling out Lloyd’s of London for particular mention in this way is most unfair. They should be instanced as a textbook example of a positive approach, based on credible independent research, with wide consultation, and leading to meaningful programmes, dealing with still-existent discriminatory culture within, and supporting appropriate development projects overseas.

Michael, perhaps time to reduce the caffeine?

Hong Kong Convention

Pakistan is a step closer to becoming a Party to the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, 2009 (Hong Kong Convention). Following an IMO-run national seminar in Karachi, Pakistan (13-15 November) to support the country’s implementation of the Convention and related Guidelines, the Pakistan (Federal) Cabinet completed the processes needed to prepare the instrument of accession to the Hong Kong Convention.

Speaking at the seminar’s closing ceremony, Pakistan’s Special Assistant to the Prime Minister (SAPM) on Maritime Affairs, Vice Admiral (Retd.) Iftikhar Ahmad Rao, reaffirmed his government’s efforts to secure Pakistan’s early accession to the Hong Kong Convention.

During group discussions, presentations and exercises, participants at the seminar learned about legal, technical and administrative aspects of the treaty, and shared best practices on safe and environmentally sound recycling of ships. Their knowledge on ship recycling and waste management was shared and, during a site visit to ship recycling yards in Gadani, Pakistan, they witnessed some of Pakistan’s ship recycling activities.

Pakistan is one of the world’s top five ship recycling countries. Its ratification and implementation of the Hong Kong Convention will contribute significantly towards greener and more sustainable ship recycling worldwide.

The Hong Kong Convention aims to ensure that ships at the end of their operational lives are recycled safely and without posing unnecessary risks to human health and the environment by placing responsibilities and obligations on all parties concerned – shipowners, ship building yards, ship recycling facilities, flag States, port States, recycling States. The Convention will enter into force on 26 June 2025.

Carriage of Electric Vehicles and Lithium-Ion Batteries

The UK Chamber of Shipping has released its new guidance, ‘Carriage of Electric Vehicles with Lithium-Ion Batteries – Information for Masters and Crew’.

Developed by the ad hoc Lithium–Ion Battery Working Group, established under the auspices of the Health & Safety Sub Committee, the group comprises members and experts with knowledge of fire and explosion hazards associated with lithium-ion batteries (LIBs).

The guide considers what information, training and equipment should be provided to seafarers. It also examines what national and international research and future regulations will be required for the safe carriage of LIBs as cargo or in electric vehicles.

The guidance, freely available as a PDF and suggested for use either as an A4 booklet or A3 poster for display on a ship or ashore, aims to provide a summary of the safe carriage of LIBs.

Please notify the Editor of your appointments, promotions, new office openings and other important happenings: contactus@themaritimeadvocate.com

And finally,

(With thanks to Paul Dixon)

A man comes to the birth registration office to register his newborn son.

The man behind the counter asks the name he wants to give to the boy, and the father replies: “Euro.”

The man says that such a name is not acceptable, because it’s a currency.

Says the father: “There were no objections when I called my first two sons Mark and Frank.”

Thanks for Reading the Maritime Advocate online

Maritime Advocate Online is a fortnightly digest of news and views on the maritime industries, with particular reference to legal issues and dispute resolution. It is published to over 20,000 individual subscribers each week and republished within firms and organisations all over the maritime world. It is the largest publication of its kind. We estimate it goes to around 60,000 readers in over 120 countries.

**

![]()

—

You are currently subscribed to martimeadvocate as: avo2018@mikeosbornecreative.co.uk.

To unsubscribe click here: https://cts.lmsslsecure.com/u?id=116685507.213a9a5d272b6e5ab73a4cc9c3347c3c&n=T&l=martimeadvocate&o=6367087

(It may be necessary to cut and paste the above URL if the line is broken)

or send a blank email to leave-6367087-116685507.213a9a5d272b6e5ab73a4cc9c3347c3c@lyris.dundee.net